In real estate development, securing funding is a critical aspect that can significantly influence the success of a project. Among the various financing structures available, forward funding and forward commitment are two prominent options. This article delves into the intricacies of forward funding vs forward commitment.

Contents

- 1 What is Forward Funding?

- 2 What is Forward Commitment?

- 3 Why Use Forward Funding vs Forward Commitment?

- 4 Benefits of Forward Funding vs Forward Commitment

- 5 How Forward Funding vs Forward Commitment Works

- 6 Structure of Forward Funding vs Forward Commitment

- 7 Challenges and Considerations of Forward Funding vs Forward Commitment

- 8 Forward Funding vs Forward Commitment

What is Forward Funding?

Forward funding is a financing arrangement where an investor agrees to fund the construction of a real estate project in stages as the development progresses. The investor typically pays the purchase price in instalments, starting with an upfront payment and continuing through various milestones until the project’s completion.

Structure of Forward Funding

In a forward funding structure, the investor acquires ownership of the land and the development rights at the outset. The payments are made in stages, often linked to specific construction milestones. This arrangement provides the developer with the necessary funds to proceed with the project without needing to secure traditional construction financing.

Key Characteristics of Forward Funding

- Milestone Payments: Payments are made at various stages of construction, such as upon completion of the foundation, framing and finishing.

- Investor Control: Investors often have a say in design and construction decisions, ensuring the project aligns with their investment criteria.

- Risk Sharing: Both parties share the risk associated with construction delays or cost overruns, as the investor’s capital is tied to the project’s progress.

What is Forward Commitment?

Forward commitment, also known as forward purchase, is a simpler structure where the investor agrees to purchase the completed project at a predetermined price once the construction is finished. Unlike forward funding, the investor does not make any payments during the construction phase but pays the full purchase price upon completion.

Structure of Forward Commitment

In a forward commitment structure, the developer retains ownership and responsibility for the project during the construction phase. The investor typically pays a reservation fee or deposit, which is only forfeited if the investor defaults. The full purchase price is paid upon the project’s completion and ownership is transferred to the investor.

Key Characteristics of Forward Commitment

- Fixed Purchase Price: The price is agreed upon before construction begins, providing certainty for both the developer and the investor.

- Minimal Investor Involvement: Investors usually have limited input during construction, focusing instead on the final product.

- Lower Risk for Investors: Investors are not exposed to construction risks, as they only pay once the project is complete.

Why Use Forward Funding vs Forward Commitment?

Let’s explore the unique advantages of forward funding vs forward commitment and why they are chosen based on the specific needs and circumstances of the parties involved.

Advantages of Forward Funding

- Cash Flow Certainty for Developers: Developers receive funds in stages, ensuring they have the capital to continue construction without relying on traditional loans.

- Investor Involvement: Investors can influence the development process, ensuring the final product meets their specifications.

- Potential for Higher Returns: By investing early, investors may achieve higher returns compared to purchasing completed projects.

- Flexibility: Developers can adjust plans based on market conditions and investor feedback during construction.

Advantages of Forward Commitment

- Reduced Risk for Investors: Investors only pay for the completed project, minimising exposure to construction risks.

- Simplified Transaction: The structure is less complex, with fewer financial and legal arrangements required during the construction phase.

- Fixed Purchase Price: The purchase price is agreed upon upfront, providing certainty for both the developer and the investor.

- Easier Financing: Developers may find it easier to secure financing for the project, knowing they have a committed buyer at the end.

Benefits of Forward Funding vs Forward Commitment

Below are the benefits of forward funding vs Forward Commitment for both investors and developers.

Benefits for Investors

Forward Funding: Investors can tailor the development to their needs, potentially achieving higher returns. They also benefit from reduced competition for completed assets and potential savings on Stamp Duty Land Tax (SDLT) in the UK.

Forward Commitment: Investors face lower risks as they only pay for the completed project. This structure provides certainty regarding the final purchase price and reduces the complexity of the transaction.

Benefits for Developers

Forward Funding: Developers gain access to necessary funds throughout the construction process, improving cash flow and reducing the need for traditional financing. They can also negotiate profit payments, incentivising timely and on-budget project delivery.

Forward Commitment: Developers retain control over the project during construction and can secure a higher sales price upon completion. This structure also reduces the complexity of financial arrangements during the construction phase.

How Forward Funding vs Forward Commitment Works

Legal and Regulatory Framework

In the UK, both forward funding and forward commitment structures are governed by various legal and regulatory frameworks. Key considerations include:

- Stamp Duty Land Tax (SDLT): Forward funding can offer SDLT savings, as the tax is typically calculated on the land purchase price rather than the completed development value.

- Planning Permissions: Developers must secure necessary planning permissions before entering into forward funding or forward commitment agreements.

- Contractual Agreements: Detailed contractual agreements are essential to outline the terms, conditions and responsibilities of both parties. This includes specifying construction milestones, payment schedules and conditions precedent for the transfer of ownership.

Market Practices

In the UK, forward funding and forward commitment are commonly used in large-scale commercial and residential developments. These structures are particularly attractive in markets with high demand for bespoke developments and where traditional financing options may be limited.

Risk Assessment

Forward Funding: Investors assume more risk as they are funding the project during construction. Delays or cost overruns can impact returns.

Forward Commitment: Investors face lower risk since they only pay upon completion, but they must ensure the developer can deliver the project as promised.

Financial Implications

Forward Funding: Offers potential for higher returns due to early investment but requires careful financial management to ensure cash flow.

Forward Commitment: Provides certainty regarding the purchase price but may limit the investor’s ability to influence project outcomes.

Investor Control

Forward Funding: Investors can exert more control over the project, which can lead to better alignment with their investment strategy.

Forward Commitment: Investors have less control during construction, focusing instead on the final product.

Structure of Forward Funding vs Forward Commitment

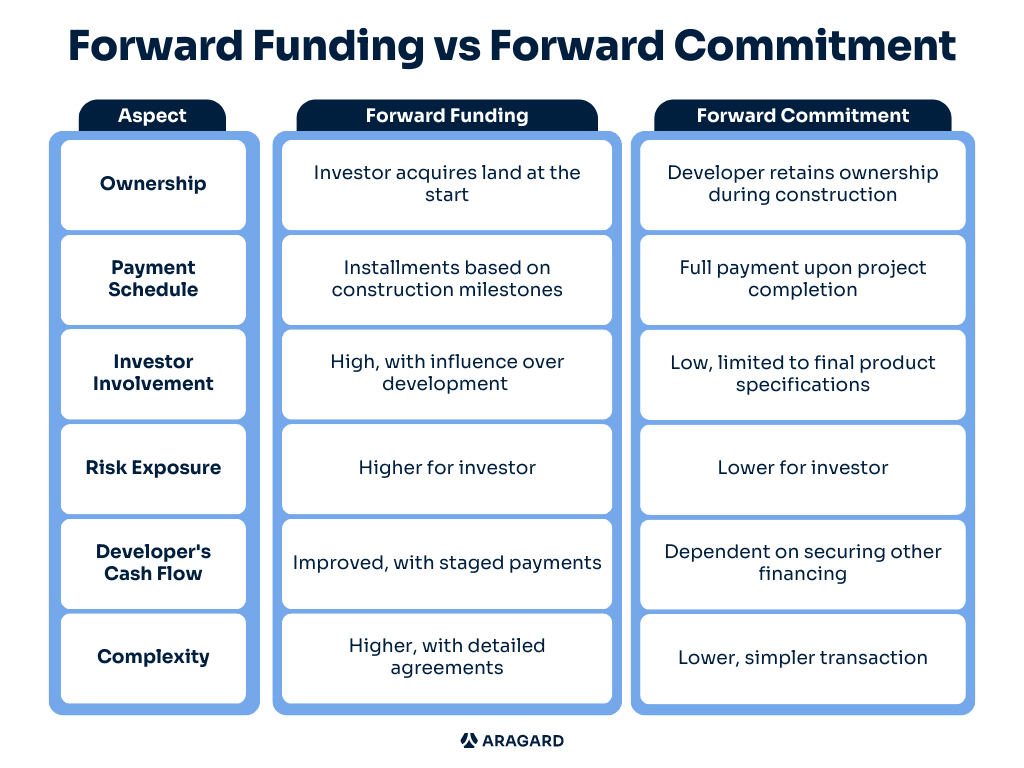

By examining these advantages side by side, we can better understand why each approach might be preferred in different scenarios. Below is a simplified chart illustrating the key differences between forward funding vs forward commitment structures:

To further illustrate the practical applications of forward funding vs forward commitment, let’s explore a couple of examples.

Example 1: Forward Funding in Action

Project Overview: A residential development in London, consisting of 100 apartments.

Structure: The developer entered a forward funding agreement with an institutional investor who provided capital in stages based on construction milestones.

Outcome: The developer was able to maintain cash flow throughout the project, leading to timely completion and a strong return on investment for the investor, who benefited from early involvement in the project.

Example 2: Forward Commitment Success

Project Overview: A commercial office building in Manchester.

Structure: The developer secured a forward commitment from a corporate investor, agreeing on a fixed purchase price upon completion.

Outcome: The developer retained full control during construction and successfully delivered the project on time. The investor benefited from a guaranteed purchase price and a high-quality asset with minimal risk.

Challenges and Considerations of Forward Funding vs Forward Commitment

While both forward funding and forward commitment offer numerous benefits, they are not without challenges.

Challenges of Forward Funding

- Construction Risks: Investors must be prepared to manage risks associated with construction delays, cost overruns and quality control.

- Complex Agreements: The need for detailed contractual agreements can lead to increased legal and administrative costs.

- Market Fluctuations: Changes in market conditions can impact the viability of the project and the expected returns.

Challenges of Forward Commitment

- Developer Reliability: Investors must conduct thorough due diligence to ensure that the developer has a track record of successful project delivery.

- Market Demand: The investor must be confident that there will be demand for the completed project, particularly in changing market conditions.

- Limited Control: Investors may have limited ability to influence the project during construction, which can be a disadvantage if issues arise.

Forward Funding vs Forward Commitment

Both forward funding and forward commitment offer distinct advantages and are valuable tools in real estate development financing. Forward funding provides developers with essential cash flow and allows investors to tailor developments to their needs, albeit with higher risk exposure. Forward commitment, on the other hand, offers investors reduced risk and transaction simplicity while enabling developers to secure higher sales prices upon project completion.

In the UK, these structures are widely used, with specific legal and regulatory considerations that must be carefully managed. By understanding the nuances of forward funding vs forward commitment, developers and investors can make informed decisions that align with their financial and strategic objectives.

Related articles